Yes, your money grows over time, except if it's just in a piggy bank. If you leave it there it goes down in value because things become more expensive over time. Money even grows while sitting in a bank account, it may only be a little bit but it is still better than in a piggy bank.

What is Investing?

Investing is putting your money towards something that will hopefully make you more money than you started with, but there is always the chance that you will end up with less money than you put in if the investment you chose did not work out.

What is a share? (AKA stocks)

Owning a share is like owning a percentage of a company, it may be a very small percentage, possibly only 0.001%, but nevertheless, it is a part of that company: meaning that your share value will go up when the company’s value goes up. Due to you only owning a very small part of the company, your share value may only change by a few cents to a couple dollars, but the change in percentage would stay in proportion, meaning if the company’s value went up 5% from $100 million to $105 million, then your share may go up from $2 to $2.10.

Depending on the company, owning shares also means that you would get a portion of the company’s profit as income, which is called a dividend. Each company is different, meaning you may only get a couple cents in dividends per share, or a dollar or two per share, and you might even not get any at all. New companies don't usually give dividends because they need all of their profits to go towards building the company, or a company may just choose not to give out dividends.

You can see the value of different shares at google.com/finance or on an app called stocks on an Apple device.

If you would like to learn about some types of shares, click here.

Property Investing

Click here to go to the page on the Income and Expenses on an Investment Property.

Yield

In relation to shares, yield is the ratio between how much you would earn in dividends per share, and how much the share is worth. You calculate yield in terms of a percentage. You would find this percentage by dividing the amount that you received per share as a dividend, by how much the share was worth on that day. This would give you a decimal between 1 and 0, so to convert it to a percentage, you would have to multiply it by 100.

For example, let’s say that you received a dividend for a share that you may own. This company paid you $1.37 per share, and the current share price is $63.46. You would have to divide the $1.37 by 63.46, and then multiply that by 100, you would want to use a calculator for this as it would be very difficult to calculate by hand. For this example, you would end up with a yield of 2.16% (if you rounded it to 2 decimal places).

You can also use yield to represent how much money you make on your investment property. At the end of the calendar or financial year, you would work out the total rent for that property over that year. You would then divide that by the purchase price of the property.

For example, let’s say you receive $15000 in rent from your property for that year. And the purchase price of the property was $450000. If you divide the $15000 by 450000, then you would end up with a yield of 4%.

Compounding Interest

Compounding interest means that if your investment goes up by 5% in one year, then another 5% the next year, then it means that it is gaining 5% of the original investment and gaining 5% on top of the 5% that it went up by the month before. And that is all without even having to add more money, the original amount of money continues to grow all on its own.

| Length of Time | Piggy Bank | Normal Bank Account | High-Interest Account | Investing App

e.g. Raiz |

| Growth Rate Per Year | -1% | 2% | 3% | 7.5% |

| Now | $100 | $100 | $100 | $100 |

| 1 Year | $99 | $102 | $103 | $107.5 |

| 2 Years | $98 | $104 | $106 | $115.5 |

| 3 Years | $97 | $106 | $109 | $124 |

| 4 Years | $96 | $108 | $112 | $133 |

| 5 Years | $95 | $110 | $115.5 | $143 |

| 10 Years | $90 | $120.5 | $134 | $204! |

As you can see, in the first year of the column on the far right, the $100 goes up by 7.5%, meaning that it grows to $107.5. But instead of growing to $115 the next month by only increasing the original $100 by 7.5%, it grows to $115.5 because you also add 7.5% of the extra $7.5. And so on. (all calculations were rounded to the nearest half dollar)

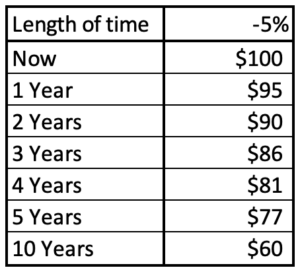

But as seen in the far left column, this also works in the reverse, although 1% is too little to see a good example of this, so I will show you a different table I made to show this in the decreasing form.

Please keep in mind that this doesn’t account for dividends or if you put extra money into this investment, if you get any dividends then this growth will also be affected by the additional value of the dividend.

There is a formula to calculate compound interest: A=P(1+R)^N. A is the amount you end up with, P is the principal, or money you started with, R meaning rate, or the percentage rise or fall in a specific time period, and N meaning the number of time periods. It is important to make sure that R and N are in the same time period, whether that is days, months or decades does not matter, they just have to match.

Simple Interest

Simple interest works in a similar, but simpler, way to compound interest, it calculates the interest based on the original value, whereas compound interest calculates repeatedly, updating the value which the interest applies to.

Simple interest would go up by the same amount every time. The formula for simple interest is I=PRN. I meaning interest, P meaning principal, or the original amount, R meaning rate, or the percentage rise or fall in a specific time period, and N meaning the number of time periods. For example, to find the interest earned over the 2 year period we would have to substitute the P for let's say $100, R for 20% per year, and N for 2 years: I=100*20%*2. It is important to make sure that R and N are in the same time period, whether that is days, months or decades does not matter, they just have to match. If we then put this into our calculator, then we would find that you would earn $40 of interest, and adding our original $100 in, you would end up with $140.

Simple interest is used for many different things, but usually short-term loans such as car loans and personal loans. It may also be used when you are paying for something, if you do not have all of the money now to buy something, then you may be able to pay it off over a couple of months, paying 2% per month as an interest fee.

When saving your money, you could put your money in a...

Piggy Bank:

If you leave your money in a piggy bank then it will actually go down over time because of something called inflation. Inflation is where your money might be worth $100 now but in 1 years time it will go down by 1% and be worth $99. If you would like to learn about what inflation is, you can watch my video on it, or read the information by scrolling down on my 'What can I do with my money?' page.

Normal Bank Account...

Normal bank accounts actually make your money worth more, only by about 1.5-2.5% but that is better than losing money. Isn't it? So after 1 year $100 will be worth around $102.

High-Interest Bank Account...

High-Interest bank accounts usually give more between 2.8 and 3.1% which is a bit more than a normal bank account. After a year $100 will be worth around $103.

Investing Apps...

I personally use an app called 'Raiz' but you could use any investing app you choose. Investing apps are the best giving 7-8% a year! After 1 year your $100 will be worth about $107!

Investing apps

As I have said above Raiz is an investing app, it takes your money that you put into it and distributes it into 7 different managed funds. Managed funds are lots of different shares of companies usually just from a single country. There is a small fee of $2.5 a month but if you ask your parents nicely then they might pay for it for you to encourage you to invest. There are also other investing apps but I use Raiz, such as First Step and many others. Click Here to go to the Raiz website.